The Financial Benefits of Smart Life Cover for High-Net-Worth Individuals sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

In this article, we will delve into the importance of life insurance for high-net-worth individuals, explore the unique features and benefits of smart life cover, discuss wealth preservation strategies, and uncover investment opportunities linked to this specialized form of life insurance.

Importance of Life Insurance for High-Net-Worth Individuals

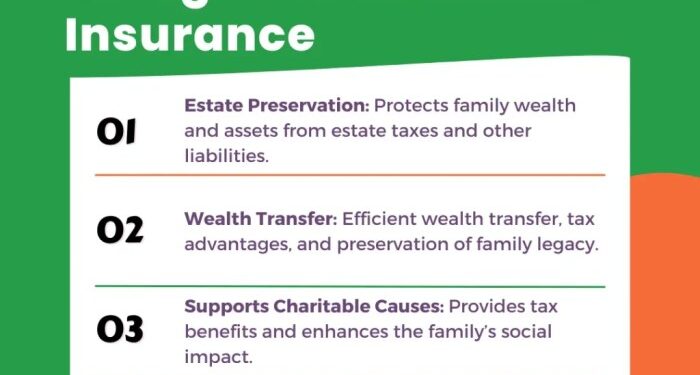

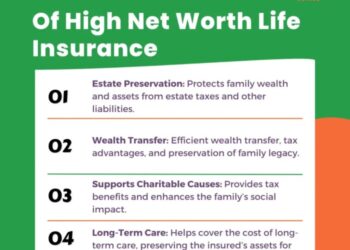

Life insurance plays a crucial role in the financial planning of high-net-worth individuals. It provides a safety net that can protect assets and ensure financial security for their families in the event of unexpected circumstances.Asset Protection and Financial Security

Life insurance acts as a shield for high-net-worth individuals by safeguarding their assets from potential risks such as estate taxes, debts, and other financial obligations. In the unfortunate event of the policyholder's death, the insurance proceeds can help cover these expenses and prevent the forced liquidation of assets.Preserving Wealth

Life insurance is a powerful tool for preserving wealth across generations. It can help mitigate the impact of estate taxes and provide liquidity to heirs, ensuring a smooth transfer of assets without significant financial burden. For high-net-worth individuals, life insurance can be a strategic component of their estate planning to maintain the family's financial legacy.Case Study: Wealth Transfer

Consider a scenario where a high-net-worth individual owns a substantial estate but wants to ensure that their heirs receive the full value without being burdened by estate taxes. By incorporating life insurance into their estate plan, they can create a tax-efficient strategy that allows the heirs to inherit the assets intact, preserving the family's wealth for future generations.Smart Life Cover Features and Benefits

Smart life cover tailored for high-net-worth individuals offers a range of specific features and benefits that set it apart from traditional life insurance policies. These tailored options provide unique advantages that can significantly enhance financial planning for individuals with substantial assets.Customized Coverage Options

Smart life cover for high-net-worth individuals often includes the ability to customize coverage based on individual needs and preferences. This customization can extend to coverage amounts, policy duration, investment options, and even premium payment schedules. By tailoring the coverage to specific financial goals and lifestyles, individuals can ensure that their insurance aligns perfectly with their overall wealth management strategies.Wealth Transfer and Estate Planning

One key benefit of smart life cover is its ability to facilitate wealth transfer and estate planning for high-net-worth individuals. These policies can be structured to provide liquidity for estate taxes, ensuring that heirs are not burdened with tax liabilities upon the policyholder's passing. Additionally, smart life cover can be used to equalize inheritance among beneficiaries, protect family businesses, and support charitable giving strategies.Investment Opportunities

Smart life cover often offers unique investment opportunities that can help high-net-worth individuals grow their wealth over time. Some policies allow policyholders to allocate a portion of their premiums towards investment accounts, providing the potential for tax-deferred growth and diversification of assets. By leveraging these investment options within their life insurance policies, individuals can enhance their overall financial portfolio and potentially increase their legacy for future generations.Legacy Protection and Preservation

Another key benefit of smart life cover is its ability to protect and preserve a family's legacy for future generations. These policies can ensure that assets are transferred efficiently and effectively, minimizing the impact of taxes and potential creditors. By structuring the policy to align with long-term financial goals, high-net-worth individuals can safeguard their wealth and ensure a lasting legacy for their loved ones.Wealth Preservation Strategies with Smart Life Cover

Mitigating Estate Taxes and Securing Generational Wealth Transfer

One of the key benefits of incorporating smart life cover into wealth preservation strategies is its ability to help mitigate estate taxes. High-net-worth individuals often face significant estate tax liabilities upon their passing, which can erode a substantial portion of their wealth. By leveraging smart life cover, individuals can create a tax-free pool of funds that can be used to cover estate taxes, ensuring that their heirs receive the intended inheritance without the burden of hefty tax bills.In addition, smart life cover can also secure generational wealth transfer by providing a guaranteed death benefit to beneficiaries. This ensures that the wealth accumulated over a lifetime is preserved and transferred to the next generation, maintaining financial stability and security for heirs. By strategically structuring the ownership and beneficiaries of the policy, high-net-worth individuals can optimize the transfer of wealth while minimizing tax implications.Comprehensive Financial Planning with Smart Life Cover

Integrating smart life cover into a comprehensive financial plan for high-net-worth individuals involves a holistic approach to wealth management. By considering the long-term financial goals and objectives of the individual, a tailored life insurance strategy can be designed to complement existing investment portfolios and estate planning structures. This proactive approach allows individuals to maximize the benefits of smart life cover, such as asset protection, tax efficiency, and wealth transfer optimization.In conclusion, smart life cover is a powerful tool that high-net-worth individuals can use to preserve and transfer their wealth effectively. By incorporating life insurance into their wealth preservation strategies, individuals can secure their financial legacy and ensure that future generations benefit from their hard work and success.Investment Opportunities Linked to Smart Life Cover

Investment opportunities tied to smart life cover for high-net-worth individuals can provide a unique avenue for financial growth and wealth preservation. By connecting smart life cover with investment portfolios, individuals can leverage the benefits of both worlds to maximize their returns and secure their financial future.Strategic Asset Allocation

Smart life cover can be integrated into an individual's investment strategy through strategic asset allocation. By allocating a portion of the insurance premiums towards investment vehicles such as stocks, bonds, real estate, or mutual funds, high-net-worth individuals can diversify their portfolio and potentially earn higher returns over time. This approach enables individuals to build a robust financial plan that combines protection with growth opportunities.- By strategically investing a portion of the premiums, individuals can benefit from potential capital appreciation and income generation.

- Smart life cover can serve as a valuable tool to enhance overall wealth accumulation and provide a safety net for the policyholder's beneficiaries.

- Successful investment strategies that incorporate smart life cover often involve a disciplined approach to asset allocation and risk management.

Concluding Remarks

As we conclude our exploration of The Financial Benefits of Smart Life Cover for High-Net-Worth Individuals, it becomes evident that this type of insurance offers a tailored approach to financial security and asset protection, making it a crucial component of any comprehensive wealth management plan for high-net-worth individuals.

Query Resolution

What are the key benefits of smart life cover for high-net-worth individuals?

Smart life cover provides tailored features that cater to the unique financial needs of high-net-worth individuals, offering enhanced asset protection and estate planning benefits.

Can smart life cover help in reducing estate taxes?

Yes, smart life cover can help mitigate estate taxes by providing liquidity to cover tax liabilities, ensuring smooth wealth transfer to future generations.