Delving into Smart Family Insurance: Protecting Your Assets in an Unpredictable Economy, this introduction immerses readers in a unique and compelling narrative, with casual formal language style that is both engaging and thought-provoking from the very first sentence.

As we explore the intricacies of Smart Family Insurance and how it safeguards your assets in today's volatile economy, we delve into a world where protection and peace of mind go hand in hand.

Understanding Smart Family Insurance

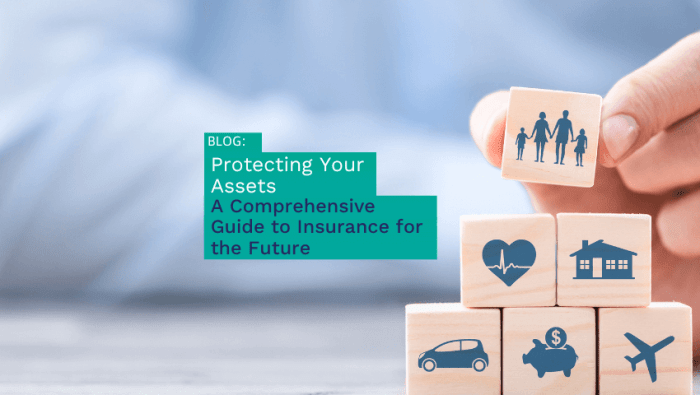

Smart Family Insurance is a comprehensive insurance package specifically designed to protect the assets of a family in the event of unforeseen circumstances. Unlike traditional insurance policies that may only cover specific aspects, Smart Family Insurance offers a holistic approach to safeguarding a family's financial well-being.In today's unpredictable economy, having Smart Family Insurance is crucial to ensure that your family is protected from unexpected financial burdens. With the rising cost of living, medical emergencies, and natural disasters, having a safety net in the form of Smart Family Insurance can provide peace of mind and financial security.Key Benefits of Smart Family Insurance

- Comprehensive Coverage: Smart Family Insurance typically covers a wide range of risks, including health emergencies, property damage, and liability issues.

- Customizable Plans: Families can tailor their insurance plans to suit their specific needs, ensuring that they are adequately protected.

- Financial Stability: In the event of a crisis, Smart Family Insurance can provide the necessary funds to cover expenses and maintain financial stability.

- Long-Term Protection: Smart Family Insurance offers long-term protection, ensuring that your family's assets are safeguarded for the future.

Types of Coverage Offered

Smart Family Insurance offers a range of coverage options to protect your assets and provide financial security for your family in uncertain times.Home Insurance

Home insurance covers your property against damages caused by natural disasters, theft, or accidents. For example, if a tree falls on your house during a storm, home insurance will help cover the cost of repairs.Auto Insurance

Auto insurance protects your vehicle in case of accidents, theft, or damage. If you get into a car accident, auto insurance will cover the cost of repairs or medical expenses.Life Insurance

Life insurance provides financial support to your family in the event of your death. It can help cover funeral expenses, outstanding debts, and provide income replacement for your loved ones.Health Insurance

Health insurance covers medical expenses such as doctor visits, hospital stays, and prescription medications. It ensures that you and your family have access to quality healthcare without worrying about the high costs.Comparison with Other Insurance Products

Smart Family Insurance stands out from other insurance products in the market by offering comprehensive coverage options tailored to the needs of families. Unlike some insurance companies that provide limited coverage or have high deductibles, Smart Family Insurance prioritizes affordability and flexibility to ensure that you and your family are adequately protected in any situation.Factors to Consider When Choosing Smart Family Insurance

When choosing a Smart Family Insurance plan, there are several key factors that individuals should take into consideration to ensure they have the right coverage for their needs. Factors such as personal assets, family size, and economic conditions can greatly impact the type and amount of coverage required. Here are some tips on how to assess the adequacy of coverage based on individual circumstances:Personal Assets

One of the most important factors to consider when selecting a Smart Family Insurance plan is your personal assets. It is crucial to evaluate the total value of your assets, including your home, vehicles, investments, and savings, to determine the level of coverage needed to protect them adequately.

Family Size

The size of your family also plays a significant role in choosing the right insurance coverage. Larger families may require higher coverage limits to ensure that all family members are adequately protected in case of unexpected events. Consider the number of dependents and their needs when determining the appropriate level of coverage.

Economic Factors

Economic factors such as income level, employment stability, and economic trends can influence the type of insurance plan that is suitable for your family

Claim Process and Customer Support

Insurance claims can be a stressful experience, but Smart Family Insurance aims to simplify the process for its policyholders. When a claim needs to be filed, customers can contact the dedicated claims department of Smart Family Insurance either through their website portal or over the phone. The claims representative will guide the customer through the necessary steps and documentation required to process the claim efficiently.

Insurance claims can be a stressful experience, but Smart Family Insurance aims to simplify the process for its policyholders. When a claim needs to be filed, customers can contact the dedicated claims department of Smart Family Insurance either through their website portal or over the phone. The claims representative will guide the customer through the necessary steps and documentation required to process the claim efficiently.Importance of Responsive Customer Support

Responsive customer support is crucial in the insurance industry, especially during times of need when customers are dealing with unexpected events such as accidents or property damage. Quick and effective communication with knowledgeable and empathetic customer support representatives can help alleviate stress and ensure a smoother claims process.- Timely Updates: Customers appreciate regular updates on the status of their claim, providing them with peace of mind and transparency.

- Clear Communication: Customer support that explains complex insurance terms and processes in simple language can help customers better understand their coverage and rights.

- Empathy and Understanding: Compassionate customer support representatives who show empathy towards the customer's situation can greatly enhance the overall experience.

Examples of Excellent Customer Support Experiences

One notable example of exceptional customer support in the insurance industry is when a representative goes above and beyond to assist a customer in a time of crisis, providing support, guidance, and reassurance throughout the claims process.Customer satisfaction in the insurance industry is often directly linked to the quality of customer support provided. By offering responsive, empathetic, and knowledgeable assistance, insurance companies like Smart Family Insurance can create a positive customer experience even during challenging times.

Wrap-Up

In conclusion, Smart Family Insurance emerges as a beacon of security in an uncertain financial landscape, offering a shield for your assets and a safety net for your family. As we navigate the unpredictable tides of the economy, this insurance stands as a stalwart protector of your hard-earned wealth.

Question & Answer Hub

What is Smart Family Insurance and how does it differ from traditional insurance?

Smart Family Insurance is a comprehensive coverage plan tailored to modern needs, offering more personalized protection compared to traditional insurance policies.

What are the key benefits of Smart Family Insurance?

Smart Family Insurance provides enhanced asset protection, peace of mind in uncertain times, and tailored coverage options to suit individual needs.

How do personal assets and family size influence the choice of Smart Family Insurance?

Personal assets and family size are crucial factors in determining the coverage needed, as they directly impact the level of protection required for your loved ones and assets.

What is the claim process like for Smart Family Insurance?

The claim process for Smart Family Insurance is streamlined and efficient, ensuring quick resolution in times of need, setting it apart from traditional insurance claims.

Why is responsive customer support important for Smart Family Insurance?

Responsive customer support is vital for immediate assistance and guidance during emergencies, creating a positive customer experience and ensuring satisfaction.